The Meritocracy Trap argues, in Chapter Eight, that feedback loops connect elite education that concentrates training in children of rich parents and a labor market that fetishizes the skills that elite education produces. As the book says, “[t]he workplace fetish for skill induces elite parents to give their children exceptional educations, and superordinate workers bend the arc of innovation to increase the fetish for skill.”[1] In this way, meritocratic inequality builds on itself, as a snowball grows rolling down a hill.

A rising skill premium straightforwardly induces rich parents to make exceptional investments in education. The meritocratic elite obviously possesses both the motive and the means to invest extravagantly in training its children; and the student bodies at elite schools and universities are manifestly dominated by children from rich households. The book’s account of the meritocratic inheritance (in Chapter Five) sets out chapter and verse.

The other half of the feedback relationship is less straightforward. The claim that the rise of a cadre of elaborately trained, super-skilled workers bends the arc of innovation to favor its own distinctive skills seems anything but obviously true. The Meritocracy Trap defends this claim (in Chapter Eight) by three types of argument.

First, the book outlines a general model of technological change that emphasizes that innovators do not follow any necessary technological logic but rather, being interested, adjust their innovations to the resources with which technology interacts, including to the human capital of the workers who will deploy it. Super-skilled workers therefore inevitably attract attention and spur innovations that would not occur—because they would not be profitable or even useful—if the workers did not exist.

Second, the book presents case studies that show that finance and management developed and deployed technologies that favor super-skilled workers directly in response to the rise of modern elite education. Because these sectors figure so prominently in the rise of the 1 percent, the case studies—even without more—reach meritocratic inequality’s core rather than just its margins.

And third, the book displays some facts about the broader economy that suggest that the training concentration generally induced the labor market to fetishize the skills that elite education develops. First, the book argues that the time-lag between the increased supply of super-skilled workers and the steep rise in the skill premium suggests the supply induced innovations that increased demand. And second, the book presents a comparison between US and German circumstances that also suggests that a feedback mechanism is in play.

This note complements these arguments, by developing in greater detail the case that the rise of a super-skilled workforce induced the demand for its own skills. The note adds two new arguments to those presented in the book. The first concerns the tepid stimulus that meritocracy has yielded for economic productivity; and the second concerns the increasing segregation between skilled and unskilled workers. The note also develops two of the arguments set out in the book in greater detail. These concern the relationship, over time, between the supply of super-skilled workers and the wage premium that these workers enjoy and the relationship, across countries, between the extent of training concentration and the size of the skill fetish. All four arguments identify patterns in the economic data produced by meritocratic inequality that would be difficult to explain if technology’s skill biases were unrelated to elite education but become straightforwardly intelligible if the rise of a super-skilled workforce induces technological innovations that favor its skills.

This approach differs qualitatively from the approach taken in the case studies that dominate the book’s approach to discerning snowball inequality. Those case studies presented detailed elaborations of the snowball mechanisms at play in finance and management and sought (always acknowledging the Humean doubt) directly to observe the causal pathways from training concentration to the skill fetish. The general arguments developed here, by contrast, do not observe causes directly but rather infer causes from the patterns taken by their consequences. These arguments propose an inference to the best explanation of observed facts.

Lawyers who specialize in evidence like to say that although a brick is not a wall and a clue is not a proof, enough bricks can build a high wall and enough clues can sustain an overwhelming case. Inferences cumulate, so that a set of considerations—none of which taken alone demonstrates that meritocracy produces snowball inequality—can each add another building block to a collectively powerful case for that conclusion. Furthermore, factual inferences become more powerful where the mechanism that they propose has compelling theoretical foundations. The theoretical idea that interested innovators naturally adapt new technologies to suit the resources, including most notably labor, alongside which they will be deployed (so that these resources exert a “demand pull” on innovation[2]) thus strengthens the empirical evidence that superordinate workers induce innovations that favor their skills. Finally, an inference is most compelling where it has been validated in important concrete cases. The book’s case studies of finance and management further fortify suggestions that training concentration drives skill-biased innovation more generally.

Arguments in the vein cannot, of course, compute the precise share of meritocratic inequality that arises through the snowball mechanisms that they discern. But such precise apportionment is both unobtainable (by any means) and anyway not required. It is enough to demonstrate that meritocratic inequality is substantially, even preponderantly, snowball inequality. The case studies of finance and management sustain this showing virtually on their own. The additional inferential power provided by general arguments is, from the point of view of the book’s larger argument, icing on the cake.

Trends in Productivity

Everything that an economy produces is made, in the end, from capital and labor. But even in their most general elaboration, these two basic inputs do not completely determine economic output. That is because even fixed quantities of capital and labor may be more or less efficiently deployed. A farm that combines $1,000 of capital with 100 hours of labor produces fewer crops when casual or rivalrous farmers deploy horse-drawn ploughs, unimproved seeds, and rudimentary means of cultivation than when disciplined and cooperative farmers deploy motorized tractors, intensively improved seeds, and sophisticated husbandry. The difference in output reflects a difference in what economists call total factor productivity (TFP).

TFP is formally defined as the portion of output not accounted for by conventional inputs (of capital and labor). In practice, as in the example, TFP reflects the level of technology deployed in production—where technology is broadly understood to include not just science and engineering but also the institutional arrangements and social norms that organize production. The TFP of farming thus varies as farms deploy casual or disciplined administration, horses or tractors, unimproved or highly cultivated seeds, and simple or sophisticated husbandry. Technological innovation—along these and other dimensions—induces total factor productivity to grow over time.

A free-standing technological boom large enough to account for the immense scale of the increased incomes captured by super-skilled workers would therefore not just skew the labor market to favor skill; it would also materially increase economic productivity overall.[3] A “third industrial revolution,” as the imagined boom is sometimes called, would sustain high productivity growth both for capital and for labor overall, on account of introducing new forms of production without suppressing any old forms.[4] (The boom’s skill bias would go to the distribution but would not diminish the size of the gains.) If technology’s path had proceeded independently of economic inequality, then new technologies would have accelerated growth and been accompanied by large gains in total factor productivity.

The best estimates find no such productivity gains, however. The economist Robert Solow, whose work on economic growth won him the Nobel Prize, once wryly admitted to being “somewhat embarrassed by the fact that what everyone feels to have been a technological revolution, a drastic change in our productive lives, has been accompanied everywhere . . . by a slowing-down of productivity growth, not by a step up. You can see the computer age everywhere but in the productivity statistics.”[5]

The statistics behind Solow’s observation are striking indeed. Total factor productivity has if anything grown more slowly during the recent decades of rising economic inequality than it did during the relatively more egalitarian decades at mid-century: growing by just 0.9 percent annually between 1980 and 2009 compared to 1.0 percent between 1950 and 1969. (The dividing decade between the two eras, the 1970s, showed truly anemic growth.) Trends in the productivity specifically of labor similarly refute any suggestion of a technological boom: the productivity of labor grew at an annual rate of 2.0 percent between 1980 and 2009, compared to an annual growth of 2.4 percent between 1950 and 1969;[6] and no decade since 1970 has produced increases in the productivity of labor as great as the 1960s.[7] Finally, trends in per capita gross domestic product again show higher growth during the Great Compression than in recent decades of rising inequality: between 1950 and 1973, real GDP per capita grew by an average of 2.5 percent per year; between 1973 and 2007, real GDP per capita grew by just 1.93 percent per year.[8] There is simply no way of parsing these data to suggest that productivity gains during the recent period of rising inequality exceed those from the prior period of stable equality, as explanations that connect inequality to free-standing technological change require. Trends in economic growth during the decades of rising inequality are simply, in the words of another leading economist, “difficult to reconcile with a technological revolution during this time period.”[9]

By contrast, these growth trends follow naturally where technological innovation is induced by training concentration and the rise of a cadre of super-skilled elite workers. Induced innovation does not so much expand technology as redirect technology toward super-skilled and away from mid-skilled workers. Induced innovation therefore shifts economic production, and especially productivity growth, toward elite workers and away from ordinary workers. Vigorously rising productivity and incomes at the top of the skill distribution are accompanied not just by stagnant productivity and wages at the middle, but also by tepid growth in total factor productivity and in the overall productivity of labor.

In this way, the recent history of economic growth reinforces the view that training concentration induces the skill fetish. Meritocracy induces snowball inequality.

Workplace Segregation by Skill

Employers confronting a predominantly mid-skilled labor force have little incentive to screen job candidates. Screening costs money, and where applicants all possess similar training, it can identify and filter only inconsequential differences in worker skill. Moreover, having hired casually, rational employers will broadly embrace production technologies that all workers across the skill spectrum can effectively deploy and will place workers of different skill levels into a single integrated labor pool. Finally, employers will adopt technologies that require unusually skilled workers only where the skill-biased technologies increase productivity by enough to outweigh the costs that employers must incur to teach the needed skills through workplace training.

Employers confronting a labor force that includes enough distinctively super-skilled workers will proceed very differently. They will screen job candidates intensively, because highly consequential skill differences make it worthwhile to incur even substantial costs to identify skill. Moreover, having hired with a deliberate eye to recruiting exceptional skill, employers will embrace production technologies that demand skilled workers. Finally, employers will abandon workplace training, as screening enables them to identify workers who are already trained. Instead of training their workers to a uniform standard, employers will ensure the effective use of skill-biased technologies by separating highly skilled from less-skilled workers.

Hiring and staffing practices thus illuminate the relationship between the skills that workers possess and the skills that employers demand. Rational employers screen job candidates for skill and separate skilled and unskilled employees only if they confront a labor force that includes a sufficiently large supply of intensively trained workers. The skill-biased technologies that such employers provide their super-skilled workers in this way owe their adoption to the training concentration that rationalizes the expenses involved in constructing the elite workforce that might deploy the technologies. Rising workplace segregation by skill reveals the workings of a snowball mechanism.

During the Great Compression, American employers managed their workforces on the first model. To begin with, mid-century employers devoted only minimal time and effort to screening job applicants. As The Meritocracy Trap reports, in the 1960s, the Ford Motor Company—a high-wage employer at the time—openly declined to screen job applicants at all, at least for blue-collar jobs: in the words of one of Ford’s managers, “If we had a vacancy, we would look outside in the plant waiting room to see if there were any warm bodies standing there. If someone was there and they looked physically OK and weren’t an obvious alcoholic, they were hired.”[10] Applicants for white-collar jobs also received very little screening. The most prestigious colleges all had pipelines by which their graduates might secure jobs at firms dominated by their alumni. The private bank Brown Brothers Harriman, for example, was a Yale firm: 11 of 16 founding partners graduated Yale, and 8 of these (including Prescott Bush) belonged to the elite secret society Skull and Bones.[11] And as the book emphasizes (in Chapter Five) the colleges themselves did virtually no screening before admitting their students: at mid-century, even Ivy League college applications were effectively non-competitive, as elite prep schools and even individual families had relationships with particular colleges. For many mid-century workers, getting a job did not involve any application at all, in the competitive sense of the term.

Mid-century employers, moreover, pooled workers of all skill levels. Certainly workers were not much segregated by skill within individual firms. The dispersed managerial technology embraced by mid-century firms—in which workers from across the skill distribution worked side by side in jobs that blended seamlessly into one another—secured this result. And workplace training provided the relatively modest skills that workers required as they moved up a firm’s hierarchy. Nor were workers sorted by skill across firms or even industries: between 1950 and 1975, even finance workers were not appreciably more skilled, on average, than other workers in the non-farm private sector. Indeed, the mid-century economy pooled the skilled and unskilled so pervasively at work that they were also pooled at home. Between 1950 and 1970, people with college degrees were “remarkably evenly distributed” across the country: between urban and rural locations, across geographic regions, and even within cities.[12]

Today, by contrast, work is organized comprehensively around skill. To begin with, firms screen job applicants immensely more closely than they did at mid-century. Nowadays only the very lowest-wage employers, seeking unskilled workers—for example, Sports Plus, which in the 1990s paid assemblers between $5.50 and $7.00 per hour—hire in the casual fashion once employed by Ford.[13] Middle-class employers who seek to fill mid-skilled jobs, embracing innovations introduced in the mid-1980s by firms such as Honda of America and Diamond Star Motors, now closely screen job applicants, using “formal cognitive tests” and “lengthy interviews.”[14] Elite employers, for their parts, screen applicants with urgent intensity. The immense competition for places at elite colleges and professional schools pre-screens job candidates even before they apply. The top firms increasingly recruit at only the very most-elite universities. And employers devote enormous attention to probing applicants even from the intensively pre-screened pools from which they recruit: banks, consulting firms, and law firms all employ several rounds of interviews, sometimes lasting a whole day; and a firm might invest upward of $1 million in recruiting at a single school.[15]

Systematic data confirm the lesson of these examples. Employers overall are devoting greater time and attention to screening job applicants.[16] Moreover, the increases are greatest among high-wage, technology-intensive employers[17]:s a recent study of nearly 3000 firms found a robust correlation between the intensity of applicant screening on the one hand and, on the other, the levels of formal education, self-reported skills, and extent of computer use among a firm’s employees.[18] Finally, the increased screening may be also be identified by its results: economy-wide data show that the matching of workers to jobs by skill and training levels has become steadily more precise over time. The share of workers who possess precisely the education level required for their jobs increased between 1976 and 1985, for example, and the extent of the education gap for mis-matched workers (the average excess years of schooling possessed by over-educated workers) declined.[19]

Screening for skill at hiring and segregation of employees by skill once in the workplace go together. Mid-century firms, having hired casually, pooled skilled and unskilled workers almost by necessity. By contrast, present-day firms, having screened and identified skilled workers at hiring, are now able to segregate their skilled from their unskilled employees. The firms, moreover, have a strong incentive to segregate, as this enables them to embrace production techniques that specifically require skilled workers (so that mixing with the unskilled would suppress the productivity of the skilled). The combination of means and motive has produced skill segregation with a vengeance. The gutting of middle management described in the book—and the elimination of the career ladders that once connected workers throughout a firm’s internal hierarchy—starkly segregate skilled managers from less-skilled production workers within the firm. Moreover, and more radically, American enterprise increasingly segregates skilled from unskilled workers into entirely separate firms.[20] College-educated workers are increasingly unlikely to work for firms that also employ workers without college degrees.[21]

Indeed, workplace segregation by skill has become even more comprehensive, as not just firms but entire geographic regions have come to specialize in either low-skilled or high-skilled workers. Mid-century America’s even distribution of college graduates is increasingly a thing of the past, as some cities have become magnets for the well-educated while others repel them. By 2000, 32 metropolitan areas had more than 34 percent college graduates in their populations, and 62 metropolitan areas had under 17 percent.[22] (For certain cities, the gap is more extreme still: 45% of the 25- to 43-year-olds in Raleigh-Durham had a college degree in 2000, as did 45% of the total population of Austin in 2004; by contrast, the percentages of college graduates among the populations of Cleveland in 2004 and Las Vegas in 2000 were 14 and 16 respectively.[23]) Moreover, by 2000, the percentage of young adults with college degrees in rural areas was half that of the average city and a much smaller fraction of the share in the most-educated cities.[24] Nor is this report of segregation a mere artifact of cherry-picking examples or even the scale of measurement: the isolation index for college graduates (a prominent measure of the extent to which college-educated people inhabit geographic spaces populated mainly by other college-educated people) more than doubled between 1970 and 2000 (rising from .13 to .28 at the county level and from .19 to .36 at the level of the census tract).[25] Segregation by skill is not a narrow or specialist phenomenon. Instead, it has become the organizing principle of work in the United States.

Having hired specifically for skill and then segregated skilled workers (into separate units within the firm, separate firms, and even separate geographic regions), firms additionally acquire a greater incentive to direct capital specifically toward their skilled workers in order to further to increase the productivity of skills.[26] Increases in the capital-to-labor ratio in the US have in recent decades been heavily concentrated in skill-intensive industries,[27] and recent decades have seen a rising spread between the capital intensity of low- and high-skilled work. One study tracked the ratio of aggregate equipment value to total employment for 450 manufacturing industries (identified by their 4-digit North American Industry Classification System codes) from the late 1950s through the middle 1990s. The study ranked firms by this ratio and measured the difference between the 90th and 10th percentiles of the distribution. This ratio remained fairly constant through the middle 1970s and then began a precipitate climb, growing by nearly 20 percent between 1975 and 1990; and the industries that most increased their capital intensity were those that hired the most-skilled workers and paid the highest wages.[28]

This rush toward high-skilled labor encompasses not just investment in existing technologies but also research and development into new technologies. In 1960, only 3 percent of private enterprise-funded research-and-development expenditures promoted innovations in office computing; by 1987, the share had risen more than four-fold, to 13%.[29] These investments disproportionately support skilled workers, as college graduates are two times more likely to use computers in their jobs than workers with only a high school education.[30] A broader view of innovation and capital only increases the concentration of investment in elite workers: the increasingly intensive training of rich children and the increasingly Stakhanovite work ethic of elite workers also reflect investments and innovations (broadly understood to encompass organizational structures and social codes) that direct new capital distinctively toward super-skilled labor. They reflect a greater deployment of human capital, in the form of skilled workers’ accumulated training, to be mixed with the workers’ ongoing labor and then an intensification of elite labor-effort to extract returns from this human capital.

Finally, all these phenomena are deeply intertwined in the United States with the rising skill premium and thus also with rising economic inequality. This comes as no surprise, but both the size of the effect and its immediate connection to screening applicants and segregating workers by skill bear emphasis. New skill-biased capital investments accelerate the rising returns to skilled labor. Capital accumulation in machinery and retail, for example, increased the skill premium by nearly 10 percent just between 1975 and 1991 (here recall the earlier account of the erosion of mid-skilled jobs in these sectors).[31] And worker segregation by skill (including across firms and whole cities) has thus been accompanied in close parallel by economic segregation. The skilled and rich now live in largely distinct geographic spaces from the rest. Whereas average city wages converged in the 1970s, they diverged in the 1990s: in that period, per-capita income in the 10 best-educated metro areas rose at over twice the rate as in the 10 worst-educated metro areas (1.8% versus 0.8% annually).[32] Individual cases are more dramatic still: wages in the 1990s rose 7.1% per year in Austin, for example.[33] Indeed, 30% of the variance in wages across regions is now statistically related to just one face of educational segregation, namely regional differences in patent production.[34] These examples cumulate to produce a general population shift: the poor were twice as geographically concentrated by census tract in 1990 as in 1970; and the rich were 20% more concentrated.[35] The neighborhood sorting index of class segregation rose roughly 25% between 1970 and 1990 (from .34 to .42).[36] All these markers become more and more prominent—dominant even—as one moves higher and higher up the skill hierarchy: by 1990, fully half of “power couples”—in which both partners are highly educated—lived in large cities.[37]

Increased dispersion in education and training, and especially the creation of an intensively trained elite, has transformed the American workplace and with it the economic landscape. Training concentration encouraged employers to intensify screening of job applicants in order to identify and hire the most-skilled workers; and, having hired based on skill, to segregate workers by skill; and, having segregated workers by skill, to create and invest in new technologies that distinctively favor skilled workers. In this way, skill—which was perhaps not quite an afterthought but certainly secondary to mid-century workplace culture and organization—has become the principal structuring ideal of the 21st-century American workplace. Innovations that favor skill were therefore not inevitable but rather induced, including specifically by rising training concentration. The increasing returns to skill associated with innovation, for their part, naturally induce a further concentration of training in children of elite parents. The reconstruction of the American workplace around skill once again attests to the snowball character of meritocratic inequality.

The Paths of Skill and Pay

The time-path of the skill premium provides further evidence that the creation of super-educated workers induced the skill-biased innovations that now make these workers so highly paid.[38] If the demand for skills charts a steady path, then the supply of skilled workers will straightforwardly determine the wage premium that skills command: as the supply rises, and especially as it rises more quickly, the premium will fall. If, on the other hand, technology-driven demand figures independently in setting the skill premium, then the relationship between the supply of skilled workers and the skill premium becomes more complicated. A rising (and even accelerating) supply might be accompanied by a rising wage premium because demand rises faster still. Finally, the joint paths charted by supply and wages permit inference not just about the changing demand for skill but also about the causes of the change. If the technical innovations that increase the demand for skill are themselves induced by a rising supply of workers sufficiently skilled to exploit them—as training concentration induces innovators to develop and firms to embrace skill-biased technologies—then the supply of skills and the skill premia will display a distinctive and highly peculiar pattern.

In the very short term—before induced innovations are conceived and implemented by firms—a burst of new supply of skills will, as before, reduce the premium that these skills command. But over the longer term—as supply-induced skill-biased innovations come online—the downward pressure on the skill premium associated with rising supply will be counteracted by an upward pressure associated with the new skill-biased technologies; and, if the innovations sufficiently favor skill, the upward pressure can come to dominate the downward, so that a rising supply of skills actually induces a rising wage premium. When the paths of skill and wages display this pattern, they suggest not just that technology-induced demand plays an independent role in boosting the wages of skilled workers but also that the rising skill fetish is caused by prior training concentration. In this case, the high wages enjoyed by skilled workers once again constitute snowball inequality.

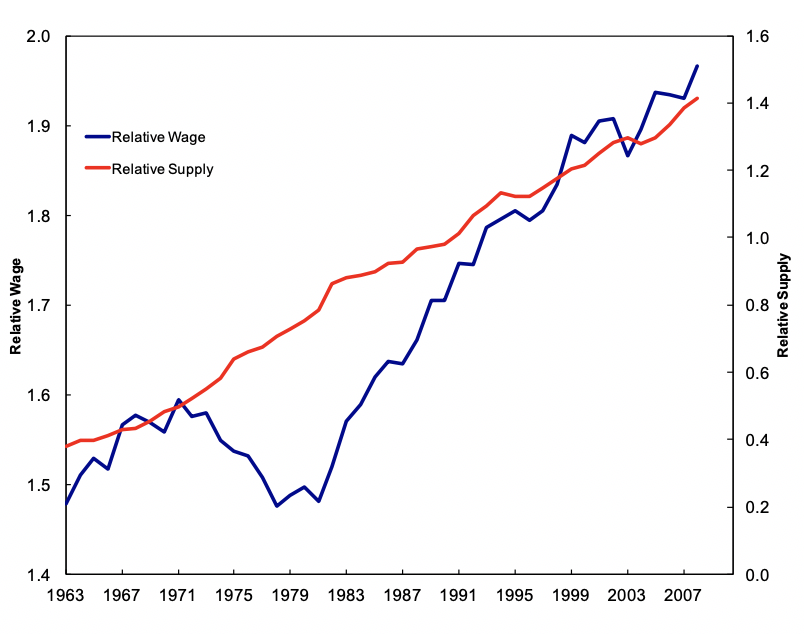

Relative Supply of College-Educated Workers and College Wage Premium over Time[39]

The figure above—produced by the economist Daron Acemoglu—charts the paths taken by the supply of skilled—that is, college-educated—workers and the college wage premium over the past half-century, and in particular during the recent decades of rising inequality. The pattern is striking. The growth in the supply of skill accelerates (the slope of the red line steepens) beginning in roughly 1970, as the post-World War II baby boom and the mid-century investment in college education intersect to produce an unprecedentedly large cohort of college graduates. (Indeed, according to another estimate, the relative supply of college-educated workers grew nearly twice as fast in the 1970s as over the previous three decades.[40]) Then, immediately following the accelerated supply of college skills, and extending through the 1970s and into the early 1980s, the college wage premium drops precipitately, as marked by the blue line’s steep downward slope. This is precisely what wages would do following a college boom if technological innovation, and the demand for skills, remained steady.

But then, entering the 1980s, the college wage premium takes a surprising turn, which is difficult to square with steady demand. The wage premium increased rapidly and almost without interruption through the present day, as marked by the blue line’s dramatic U-turn between 1978 and 1982. This suggests a sudden, rapid increase in the demand for college skills, beginning roughly a decade after the sudden rise in the supply of college-educated workers. (And indeed, a separate estimate finds that the demand for college skills grew over one-and-a-half times faster in the 1980s than over the previous four decades.[41]) Moreover, the college wage premium continued to rise steeply in subsequent decades, even as the relative supply of college skills also increased (with only a modest reduction in the pace of growth).

The natural explanation for this pattern—for the timing of the rising demand for college skills—is that innovators responded to the rising supply of college-educated workers by inventing and implementing new technologies of production that favored precisely the newly available skills. Skill-biased technical change did not proceed independently but instead followed the supply of skilled workers. The recent paths of the supply of and demand for college skills thus favor the view that technological innovation is not independent of but rather induced by education—that a rising supply of skilled workers induced skill-biased technological innovations that, in time, sufficiently increased the demand for skills to drive up the skill premium.

These patterns and relationships replay themselves at the very top of the skill and wage distributions.[42] The data behind the figure charting the supply of college skills and the college wage premium do not separate out either the very top graduates or the very highest wages. Nevertheless, the recent histories of super-elite education and of the labor incomes of the 1 percent—taken all together—reprise the pattern of the figure.

Begin by considering the path taken by the supply of super-elite skills since the middle of the last century, as laid out in the narrative developed in The Meritocracy Trap. The clubby non-competitiveness that America’s top universities preserved at mid-century, combined with the elite’s enduring embrace of an ethic of leisure, entailed that for most of the Great Compression the country produced no systematic supply of super-skilled labor. Exceptionally skilled individuals certainly existed, as did exceptionally hard workers. But these remained the exception rather than the rule among the mid-century elite, who for the most part remained undistinguished as students (the prep schools that fed Yale most of its students were badly underrepresented among its academic honor societies), unmotivated as graduates (see Harvard’s jobless class of 1973), and indolent in their jobs (see mid-century Wall Street’s mid-afternoon wind-down). Before elite education remade itself on a meritocratic model in the late 1960s and early 1970s, the country lacked the institutions required to produce a super-skilled workforce at scale. And before elite work reimagined itself on a Stakhanovite model in the late 1970s and early 1980s, the country lacked the social norms required to motivate widespread super-skilled work effort. The supply of super-skilled labor remained small throughout the middle of the 20th century and then spiked toward the end of the Great Compression.

The earlier narrative also lays the groundwork for inferring the recent course of the demand for super-skilled labor. The top 1 percent’s income share reached its bottom not in the middle but rather at the very end of the Great Compression, falling from over 10 percent in the late 1960s to 8.3 percent in 1976.[43] Top incomes then grew rapidly, beginning in the late 1970s and accelerating dramatically in the early and mid-1980s, so that by 1988, the top 1 percent’s income share had almost doubled to reach nearly 15 percent.[44] Moreover, top incomes today go overwhelmingly to super-skilled workers who possess super-elite educations. As the book points out (see Figure 9), “[j]ust 1.3 percent of high school dropouts, just 2.4 percent of high-school-only workers, and just 17.2 percent of workers with a BA only earn as much as the median professional school graduate.”[45] And the very most-elite, highest-paying employers recruit exclusively at the most-elite colleges and universities.

These data suggest that, as with generic college skills, the demand for super-skills also lagged the supply. A spike in supply starting in the late 1960s and early 1970s—in what would turn out to be the swan song of American economic equality—initially drove down the relative return not just to generic college skills but to super-skills also. But then, as innovation adjusted technologies of production to take advantage of newly abundant super-skilled labor, demand shot up. Eventually—beginning in the late 1970s and running through the mid-1980s, and indeed most of the decades since—demand rose sufficiently to outweigh the increase in supply (which, as in the earlier supply-side account, soon stagnated), driving up relative wages. The micro-histories rehearsed in the book fill in these broad outlines and confirm this account. (As always, data concerning super-elite workers merge back into anecdote.) The surplus physicists and engineers produced in the 1960s and early 1970s and the newly trained MBAs produced in the 1970s and 1980s became the finance workers and managers whose massive incomes drove inequality in the 1980s and beyond. In this way, the working rich were born.

The paths of skill and pay suggest that demand for not just college skills but also super-elite skills grew in response to new supply, just as the model of induced innovation by interested entrepreneurs proposes. This finding—especially with respect to super-skills—should come as no surprise. The book’s case studies of finance and management make plain that it would be madness to design and build the production technologies employed today in finance or management without a deep supply of super-skilled and Stakhanovite workers who might deploy them. The training concentration that provides the supply of elite workers today was needed to underwrite the technological innovations that produce the demand for such workers and thus also their immense labor incomes. The paths of skill and pay suggest, once again, that the inequality that flows from elite labor incomes is snowball inequality.

Skill and Wages Across Nations

A final argument that elite American labor incomes constitute snowball inequality compares training concentration and the skill fetish across countries and finds correlations that comport the feedback loops involved in snowball inequality.[46] The Meritocracy Trap develops this argument through a brief pairwise comparison between the United States and Germany[47] and then generalizes the argument by observing a correlation between training concentration and the skill fetish across OECD countries.[48] Adding details to the account of the German case fleshes out the book’s argument.

On the one hand, even as the United States has concentrated its educational investments in an increasingly narrow elite, Germany has spread education increasingly broadly, over a larger and larger segment of its population. Between 1970 and 2015, Germany increased the share of students attending the academic high schools (called Gymnasia) that qualify graduates for university places and the professions from under a tenth to over a third.[49] German universities naturally experienced parallel increases in enrollments: while roughly 5 percent of German adults had university degrees in 1970, roughly half of Germans enroll in and roughly a third of Germans graduate from university today.[50] Moreover, all members of this broad German elite receive effectively equivalent educations: Germany has virtually no private schools or universities, and while there are elite faculties in the German public university system, there are virtually no exceptionally competitive or distinctively elite student bodies.

Finally, Germany also provides intensive workplace training to those outside of the university-educated elite. German firms, supported by the German state, have embraced a massive program of vocational education, with over 70 percent of young German workers receiving formal workplace training (as compared to only 10 percent in the United States).[51] The training, moreover, can be intensive, as German firms commonly offer young workers apprenticeships that cost employers as much as $10,000 per apprentice per year.[52] Workplace training binds workers to firms, and so worker turnover rates convey the extent of training and conspicuously reveal the size of the difference between the United States and Germany: while the median male US worker holds 6 jobs in his first decade in the labor market, the median German holds between 1 and 3.[53]

Together, these practices establish a stark contrast between German and American education writ large: whereas training in the United States is intensively and increasingly concentrated in a narrow elite, training in Germany is widely, and indeed likely increasingly, dispersed across the broader workforce.

On the other hand, US and German firms have in recent decades focused their attentions on very different segments of the labor market. American firms allocate new investments in plants and machinery disproportionately to complement high-skilled workers. Recent decades have therefore seen a rising spread in the United States between the capital intensity of low- and high-skilled work. One study found that beginning in the 1970s, manufacturing firms that employed more-skilled workers began to invest more heavily in equipment than those that employed less-skilled workers.[54] More broadly, increases in the capital-to-labor ratio in the US economy have generally been heavily concentrated in skill-intensive industries.[55] Moreover, the rush toward investing in capital that complements specifically high-skilled labor encompasses not just investment in existing technologies but also research and development into new ones. Once again, in 1960, only 3 percent of privately funded research and development expenditures promoted innovations in office computing; by 1987, the share had risen four-fold, to 13 percent.[56] College graduates are twice as likely to use computers in their jobs than workers with only a high school education.[57] German firms, by contrast, have over the same period dispersed new capital investments much more widely across the economy. If anything, new capital deepening in Germany has been skewed toward sectors in which unskilled or mid-skilled labor dominates production.[58]

Labor becomes more productive as it gains more capital to work with, and more-productive labor captures greater wages. The patterns taken by new investment, and in particular whether capital chases skilled or unskilled workers, therefore influence the skill premium. The effects, moreover, are large: between just 1975 and 1991, for example, capital accumulation in manufacturing and retail in the United States increased the skill premium by about 8 percent, even as capital deepening in these sectors decreased wage differentials in Germany; and—astonishingly, to US eyes—the 1991 wage differential in German banking would have been a third higher had the capital/labor ratio remained at 1975 levels.[59] Overall, capital deepening in the United States has been associated with increased wage dispersion and rising skill premia; while in Germany capital deepening has been associated with wage compression and falling returns to skill.

Capital investments in the United States and Germany adjust in light of the skill distribution of the labor forces that will deploy them; and incomes follow suit. In the United States, new capital chases skilled and especially super-skilled labor, and capital investments drive up elite workers’ productivity and wages. In Germany, by contrast, new capital chases mid-skilled labor, and capital investments drive up middle-class wages. Concentrated training elevates returns to skill in the United States, and dispersed training depresses returns to skill in Germany. In this way, the comparison reveals that training concentration in the US causes the skill fetish, so that rising returns to skill constitute snowball inequality.

The Cumulative Case

Causes resist our understanding. As David Hume observed, we possess no faculty that can sense a cause directly, even in the simplest case.[60] (We cannot perceive but only surmise that the bat causes the ball to fly away.) The complex interactions described in The Meritocracy Trap, especially among the overlapping causes behind snowball inequality, only compound the difficulty. They make it impossible for the book to deploy the approaches to discerning causes that dominate the natural and social sciences. Controlled experiments seek to isolate true causes by eliminating confounding alternatives. And formal statistical techniques exploit natural variation in the service of causal inference, in effect by reverse-engineering the unplanned world to replicate an experimenter’s artifice. But controlled experiments on a societal scale are impossible; and rising inequality so pervades social and economic life that it defeats the natural variations on which statistical inference depends.

In place of these formal techniques, the book deploys an informal and cumulative approach to discerning causes. First, it identifies a set of incentives and capacities that, in theory, sustain the causal mechanisms that the book describes. Rising elite wages give the rich an incentive to secure elaborate educations for their children. And a cadre of super-skilled, Stakhanovite workers gives innovators an incentive to develop new technologies that complement these workers’ skills. Second, the book deploys detailed case studies to show that these mechanisms do not just appear to the theoretical imagination but actually operate in practice. The studies of finance and management, in particular, show that the mechanisms operate in the economic sectors that dominate top incomes today. Finally, the book marshals broader data from across the economy to display patterns that are congruent with the causal mechanisms it identifies but that become incongruous on alternative accounts. These data include: meritocracy’s tepid stimulus for economic productivity; meritocracy’s embrace of commercial segregation between skilled and unskilled workers; the relationship, over time, between the supply of super-skilled workers and the income premium that these workers enjoy; and the relationship, across countries, between the extent of training concentration and the size of the skill fetish.

Causes resist understanding, and a brick is not a wall. But when a causal mechanism is theoretically intelligible, appears prominently on the face of important particular cases, and rationalizes broader consequences better than alternative accounts, this gives good reasons to believe that the mechanism is in fact at play. Even more-formal approaches—which claim experimental or statistical authority—do not in the end identify causes more clearly. Experimental inference remains constrained by the experimenter’s imagination and clarity of mind. And natural variation rarely resembles an ideal experiment. Causation, Hume’s skepticism teaches, is always and necessarily a matter not of proof but of the balance of doubt. The arguments marshalled in the book, and supplemented here, seek to persuade that the balance of doubt favors believing the explanation for meritocratic inequality that the snowball mechanisms provide.

Finally, understanding causes also pays forward-looking dividends: it helps to reassert control over snowballing inequality by sustaining the instincts to reject, to resist, and to reform the present unequal social and economic order. A clear understanding of the snowball mechanism inspires an articulate moral language for criticizing maldistribution whose meritocratic bona fides defy more familiar egalitarian impulses; it identifies political coalitions that might oppose meritocratic inequality going forward; and it recommends practicable policies that might slow, or even reverse, meritocratic inequality’s heretofore unstoppable rise.

[1] Daniel Markovits, The Meritocracy Trap: How America’s Foundational Myth Feeds Inequality, Dismantles the Middle Class, and Devours the Elite (New York: Penguin Press, 2019), 240. My account of induced innovation, both in the book and in this note, owes a substantial debt to Daron Acemoglu’s work, including, but not limited to, his “Technical Change, Inequality, and the Labor Market,” Journal of Economic Literature 40, no. 1 (March 2002), https://economics.mit.edu/files/4124.

[2] See generally Jacob Schmookler, Invention and Economic Growth (Cambridge, MA: Harvard University Press, 1966).

[3] The argument concerning TFP growth borrows from Acemoglu, “Technical Change, Inequality, and the Labor Market.”

[4] See, e.g., “The Third Industrial Revolution,” Economist, April 21, 2012, https://www.economist.com/leaders/2012/04/21/the-third-industrial-revolution. The first two industrial revolutions, on this view, were associated with the rise of machine production in Britain at the end of the 18th century and the mastery of the moving assembly line in the United States at the start of the 20th century. The proposed third industrial revolution concerns the rising digitization of production.

[5] Robert Solow, “We’d Better Watch Out,” New York Times Book Review, July 12, 1987 (reviewing Stephen S. Cohen and John Zysman, Manufacturing Matters: The Myth of the Post-Industrial Economy (New York: Basic Books, 1987)), http://www.standupeconomist.com/pdf/misc/solow-computer-productivity.pdf.

[6] Growth rates calculated using data from the Bureau of Labor Statistics, Major Sector Productivity and Costs, Nonfarm Business Labor Productivity series.

[7] The productivity of labor grew by nearly 30 percent in the 1960s and then by just 19 percent, 16 percent, 20 percent, and 25 percent in the 1970s, 1980s, 1990s, and 2000s respectively. Growth rates calculated using data from the Bureau of Labor Statistics, Major Sector Productivity and Costs, Nonfarm Business Labor Productivity series.

[8] Charles I. Jones, “The Facts of Economic Growth,” in Handbook of Macroeconomics, ed. John B. Taylor and Harald Uhlig, vol. 2A (Amsterdam: Elsevier, 2016), table 1, https://web.stanford.edu/~chadj/facts.pdf.

[9] Acemoglu, “Technical Change, Inequality, and the Labor Market,” 11.

[10] Richard J. Murnane and Frank Levy, Teaching the Basic New Skills (New York: Free Press, 1996), 19, quoted in Daron Acemoglu, “Changes in Unemployment and Wage Inequality: An Alternative Theory and Some Evidence,” American Economic Review 89, no. 5 (December 1999): 1270, https://economics.mit.edu/files/3906.

[11] “Business: Brown-Harriman,” TIME, December 22, 1930, http://content.time.com/time/magazine/article/0,9171,740853,00.html. See also Kevin Phillips, American Dynasty: Aristocracy, Fortune, and the Politics of Deceit in the House of Bush (New York: Penguin Group, 2004), 35 (referring to the “Skull and Bones hegemony at Brown Brothers Harriman (Averell Harriman, E. Roland Harriman, Robert A. Lovett, Artemus Gates, Prescott Bush, and several others).”)

[12] Edward Glaser and Christopher Berry, “The Divergence of Human Capital Levels Across Cities” (working paper no. 11617, National Bureau of Economic Research, 2005), 10, 37, table 4, https://www.nber.org/papers/w11617.pdf.

[13] Murnane and Levy, Teaching the Basic New Skills, referenced in Acemoglu, “Changes in Unemployment and Wage Inequality: An Alternative Theory and Some Evidence,” 1270.

[14] Murnane and Levy, Teaching the Basic New Skills, referenced in Acemoglu, “Changes in Unemployment and Wage Inequality: An Alternative Theory and Some Evidence,” 1270.

[15] Lauren Rivera, Pedigree: How Elite Students Get Elite Jobs (Princeton, NJ: Princeton University Press, 2015), 34.

[16] Peter Cappelli and Steffanie L. Wilk, “Understanding Selection Processes: Organization Determinants and Performance Outcomes” (working paper no. 97-14, Center for Economic Studies, 1997), https://www2.census.gov/ces/wp/1997/CES-WP-97-14.pdf, cited in Acemoglu, “Technical Change, Inequality, and the Labor Market,” 46.

[17] Cappelli and Wilk, “Understanding Selection Processes: Organization Determinants and Performance Outcomes,” 24–25, cited in Acemoglu, “Technical Change, Inequality, and the Labor Market,” 46.

[18] Cappelli and Wilk (1997), 42–43, table 3, cited in Acemoglu, “Changes in Unemployment and Wage Inequality: An Alternative Theory and Some Evidence,” 1270.

[19] Acemoglu, “Changes in Unemployment and Wage Inequality: An Alternative Theory and Some Evidence,” 1272, table 1. Acemoglu tests the robustness of these results against effects concerning the changing composition of the workforce, e.g., a rising share of young workers who tend to be over-educated.

[20] Acemoglu, “Technical Change, Inequality, and the Labor Market,” 48–49.

[21] Bill Bishop, The Big Sort: Why the Clustering of Like-Minded America is Tearing Us Apart (New York: Houghton Mifflin Harcourt, 2009), 135; Richard Florida, The Rise of the Creative Class: And How It’s Transforming Work, Leisure, Community, and Everyday Life (New York: Basic Books, 2014), 236–42.

[22] Bishop, The Big Sort, 131.

[23] Bishop, The Big Sort, 131.

[24] Bishop, The Big Sort, 132.

[25] Douglas S. Massey, Jonathan Rothwell, and Thurston Domina, “The Changing Bases of Segregation in the United States,” Annals of the American Academy of Political and Social Science 626, no. 1 (October 2009): 83. Massey also reports that the high school college dissimilarity index rose 50% between 1970 and 2000 (from .16 to .24) at the county level and from .21 to .34 by census tract.

[26] Acemoglu, “Technical Change, Inequality, and the Labor Market,” 12. See also Acemoglu, “Changes in Unemployment and Wage Inequality: An Alternative Theory and Some Evidence,” 1275–76.

[27] Winfried Koeniger and Marco Leonardi, “Capital Deepening and Wage Differentials: Germany Versus US,” Economic Policy 22, no. 49 (January 2007): 74. For an account of the contrasting development in Europe, see also Daron Acemoglu, “Cross-Country Inequality Trends,” Economic Journal 113 (February 2003): F146.

[28] Francesco Caselli, “Technological Revolutions,” American Economic Review 89, no. 1 (March 1999): 93–95, figs. 3–4, 97, fig. 7, https://personal.lse.ac.uk/casellif/papers/techrev.pdf, cited in Acemoglu, “Changes in Unemployment and Wage Inequality: An Alternative Theory and Some Evidence,” 1275–76.

[29] Daron Acemoglu, “Why Do New Technologies Complement Skills? Directed Technical Change and Wage Inequality,” Quarterly Journal of Economics 113, no. 4 (November 1998): 1083, https://economics.mit.edu/files/3809 (citing NSF data). For more recent updates, see https://ncses.nsf.gov/pubs/nsf19318/#&.

[30] David H. Autor, Lawrence F. Katz, and Alan B. Krueger, “Computing Inequality: Have Computers Changed the Labor Market?” Quarterly Journal of Economics 113, no. 4 (November 1998): 1187, 1188, table IV, https://economics.mit.edu/files/11555, cited in Acemoglu, “Why Do New Technologies Complement Skills? Directed Technical Change and Wage Inequality,” 1083. For more recent data confirming similar ratios, see https://www.census.gov/data/tables/2010/demo/computer-internet/computer-use-2010.html (table 4) (23.7% for high school diploma; 62.3% for bachelor’s degree), https://nces.ed.gov/programs/digest/d08/tables/dt08_432.asp (40.4% for high school diploma; 82.0% for bachelor’s degree), https://www.bls.gov/news.release/pdf/ciuaw.pdf (42.2% for HS, 83.8% for bachelor’s).

[31] Koeniger and Leonardi, “Capital Deepening and Wage Differentials: Germany Versus US,” 76.

[32] Bishop, The Big Sort, 131–32. The economic gains of the 1990s were heavily concentrated in merely 30 “fabulously wealthy” zip codes. Chuck Collins and Felice Yeskel, Economic Apartheid in America (New York: New Press, 2005), 3.

[33] Bishop, The Big Sort, 134. Bishop cites Michael Porter, “The Economic Performance of Regions,” Regional Studies 37 (August/October 2003), 550–51.

[34] Bishop, The Big Sort, 134. Bishop cites Porter, “The Economic Performance of Regions,” 553.

[35] Massey, Rothwell, and Domina, “The Changing Bases of Segregation in the United States,” 83. The average poor family lived in a census tract that was 14% poor in 1970 versus 28% poor in 1990; the average affluent family lived in a tract that was 31% affluent in 1970 versus 36% affluent in 1990.

[36] Massey, Rothwell, and Domina. For more on economic segregation, see Paul A. Jargowsky, “Take the Money and Run: Economic Segregation in U.S. Metropolitan Areas,” American Sociological Review 61, no. 6 (December 1996); Paul Jargowsky and Todd Swanstrom, Economic Integration: Why It Matters and How Cities Can Get More of It (CityVitals Series, 2009), https://www.forwardcities.org/wp-content/uploads/2018/04/Economic-Integration-Report-Why-It-Matters-and-How-Cities-Can-Get-More-of-It.pdf.

[37] Dora L. Costa and Matthew E. Kahn, “Power Couples: Changes in the Locational Choice of the College Educated, 1940–1990,” Quarterly Journal of Economics 115, no. 4 (November 2000): 1287, http://econ2.econ.iastate.edu/classes/econ321/orazem/costa_dual-career.pdf.

[38] The argument that follows reprises Acemoglu, “Technical Change, Inequality, and the Labor Market” and Acemoglu, “Why Do New Technologies Complement Skills? Directed Technical Change and Wage Inequality.”

[39] The data behind the figure come from Daron Acemoglu and David Autor, “Skill, Tasks and Technologies: Implications for Employment and Earnings,” in Handbook of Labor Economics, ed. Orley Ashenfelter and David Card, vol. 4b (Amsterdam: Elsevier, 2011), https://economics.mit.edu/files/7006. Acemoglu and Autor use raw data from the Bureau of the Census’s March CPS. Acemoglu deploys a similar figure to support a similar argument in Acemoglu, “Technical Change, Inequality, and the Labor Market,” 15, fig. 1.

[40] According to this estimate, the relative supply of college-educated workers (measured as 100 times annual log changes) grew by a factor of 2.35 in the 1940s, 2.91 in the 1950s, 2.55 in the 1960s, and 4.99 in the 1970s. Claudia Goldin and Lawrence F. Katz, The Race Between Education and Technology (Cambridge, MA: Belknap Press, 2008), 297, table 8.1. Goldin and Katz note elsewhere that the supply of skilled workers measured more broadly—by the mean years of education of the American workforce—also increased more rapidly between 1960 and 1980 than in the decades either before or afterward. Between 1940 and 1960, the mean worker’s education increased by 1.52 years; between 1960 and 1980, the increase was 1.93 years; and between 1980 and 2005, the increase was 1.08 years. Goldin and Katz, 39, table 1.3.

[41] According to this estimate, the relative demand of college-educated workers (measured as 100 times annual log changes) grew by a factor of -0.69 in the 1940s, 4.28 in the 1950s, 3.69 in the 1960s, and 3.77 in the 1970s, and 5.01 in the 1980s. Goldin and Katz, 297, table 8.1 (these numbers come from the column that uses the preferred estimate for the elasticity of substitution between skilled and unskilled labor, 1.64).

[42] Acemoglu, who aspires to a general theory of induced innovation—a general account of the relationship between the skill distribution of the labor pool and the skill bias of new technologies—proposes that the pattern also arose, in an earlier era, nearer the bottom of the skill distribution. Acemoglu suggests that the returns to a high school education, after declining in response to rising supply during the first years of the high school boom in the earlier part of the 20th century, then rose rapidly as the new supply of high school-educated workers induced innovations that increased the demand for high school skills. Acemoglu, “Technical Change, Inequality, and the Labor Market,” 11–12. Labor economist and later senator Paul Douglas embraced a similar explanation when he suggested that newly invented office machinery reduced the demand for high school clerical skills over the first decades of the 20th century (although Douglas did not claim that the rise of high school education induced these innovations). Goldin and Katz, The Race Between Education and Technology, 288, citing Paul H. Douglas, Real Wages in the United States: 1890-1926 (Boston: Houghton Mifflin, 1930).

Goldin and Katz, by contrast, claim that the return to high school fell for much longer in response to rising supply, falling steadily from 1915 right through the early 1950s—probably too long a period for the induced innovation theory to explain its path. Claudia Goldin and Lawrence F. Katz, The Race Between Education and Technology (Cambridge, MA: Belknap Press, 2008), 82, 85, fig. 2.9, 288–89. One possible account for this disagreement about the facts is that Acemoglu reports the return to a high school degree while Goldin and Katz emphasize the return to an additional year of post-elementary schooling. It is not immediately obvious whose analysis this difference favors.

[43] World Inequality Database (“Top 1% Fiscal Income Share, USA, 1913-2015”), https://wid.world/share/#0/countrytimeseries/sfiinc_p99p100_z/US/2015/eu/k/p/yearly/s/false/7.476000000000002/25/curve/false/1913/2015.

[44] World Inequality Database (“Top 1% Fiscal Income Share, USA, 1913-2015”), https://wid.world/share/#0/countrytimeseries/sfiinc_p99p100_z/US/2015/eu/k/p/yearly/s/false/7.476000000000002/25/curve/false/1913/2015.

[45] Markovits, The Meritocracy Trap, 305.

[46] Zach Liscow suggests that the snowball mechanism should produce a cross-country correlation between levels of inequality in 1970 and the increase in inequality between 1970 and today. On this point, see also Alberto Alesina and George-Marios Angeletos, “Fairness and Redistribution,” American Economic Review 95, no. 4 (2005), https://economics.mit.edu/files/335 and Alberto Alesina and Eliana La Ferrara, “Preferences for Redistribution in the Land of Opportunities,” Journal of Public Economics 89 (2005): 928, table 12, 929, https://scholar.harvard.edu/files/alesina/files/preferences_for_redistribution_in_the_land_of_opportunities.pdf, which argue that there is a feedback loop between current redistribution and preferences for redistribution in the future, as redistribution encourages popular belief that the rich are unfairly so.

[47] Markovits, The Meritocracy Trap, 252-54.

[48] Markovits, 307, fig. 11.

[49] “Abitur Für Alle!,” Welt am Sonntag, June 15, 2014, https://www.welt.de/print/wams/article129082343/Abitur-fuer-alle.html.

[50] Etienne Albiser and Désirée Wittenberg, Country Note: Education at a Glance 2014—Germany (Organisation for Economic Co-operation and Development, 2014), 4, https://www.oecd.org/edu/Germany-EAG2014-Country-Note.pdf.

[51] Daron Acemoglu and Jörn-Steffen Pischke, “The Structure of Wages and Investment in General Training,” Journal of Political Economy 107, no. 3 (June 1999): 542n3, https://economics.mit.edu/files/3904. The authors cite an OECD report that in Germany 71.5 percent of young workers receive formal training while only 10.2 percent of US workers receive any formal training during their first 7 years of work (the shares in Japan and France are 67.1 and 23.6 percent respectively).

[52] Dietmar Harhoff and Thomas J. Kane, “Is the German Apprenticeship System a Panacea for the U.S. Labor Market?,” Journal of Population Economics 10, no. 2 (June 1997), referenced in Acemoglu and Pischke, “The Structure of Wages and Investment in General Training,” 540; Daron Acemoglu and Jörn-Steffen Pischke, “Why Do Firms Train? Theory and Evidence,” Quarterly Journal of Economics 113, no. 1 (February 1998): 98, 99, table I, https://economics.mit.edu/files/3806.

[53] Acemoglu and Pischke, “Why Do Firms Train? Theory and Evidence,” 114 (estimating “one or two”), cited in Acemoglu and Pischke, “The Structure of Wages and Investment in General Training,” 549; Christian Dustmann and Costas Meghir, “Wages, Experience and Seniority,” Review of Economic Studies 72 (2005): 86, 87, fig. 1 (estimating 2.8 jobs for “skilled” workers and 3.4 jobs for “unskilled” workers).

[54] Caselli, “Technological Revolutions,” 93–95, figs. 3–4, 97, fig. 7, cited in Acemoglu, “Changes in Unemployment and Wage Inequality: An Alternative Theory and Some Evidence,” 1275–76.

[55] Koeniger and Leonardi, “Capital Deepening and Wage Differentials: Germany Versus US,” 74; Acemoglu, “Cross-Country Inequality Trends”; Daron Acemoglu and Jörn-Steffen Pischke, “Minimum Wages and On-the-Job Training,” [page number], in Research in Labor Economics, ed. Solomon W. Polachek, vol. 22 (Oxford: Elsevier Science, 2003); Acemoglu, “Changes in Unemployment and Wage Inequality: An Alternative Theory and Some Evidence,” 1259.

[56] Acemoglu, “Why Do New Technologies Complement Skills? Directed Technical Change and Wage Inequality,” 1083. Acemoglu cites to data collected by the National Science Foundation.

[57] Autor, Katz, and Krueger, “Computing Inequality: Have Computers Changed the Labor Market?,” 1187, 1188, table IV, cited in Acemoglu, “Why Do New Technologies Complement Skills? Directed Technical Change and Wage Inequality,” 1083.

[58] Koeniger and Leonardi, “Capital Deepening and Wage Differentials: Germany Versus US”; Acemoglu, “Cross-Country Inequality Trends”; Acemoglu and Pischke, “Minimum Wages and On-the-Job Training”; Acemoglu, “Changes in Unemployment and Wage Inequality: An Alternative Theory and Some Evidence,” 1259.

[59] Koeniger and Leonardi, “Capital Deepening and Wage Differentials: Germany Versus US,” 94. Note that Koeniger and Leonardi test this conclusion against alternative explanations that emphasize other general differences between the US and German labor markets, including generally higher German unemployment over the period and greater skill specificity in European production.

[60] David Hume, A Treatise of Human Nature, ed. David F. Norton and Mary J. Norton (New York: Oxford University Press, 2000), book 1, part 3, sec. 4; David Hume, An Enquiry Concerning Human Understanding, ed. Tom L. Beauchamp (New York: Oxford University Press, 1999), sec. 4.

How America’s foundational myth feeds inequality, dismantles the middle class, and devours the elite.